CMS students get Reality Check

Published 3:37 pm Friday, February 16, 2018

By JOYANNA LOVE/ Senior Staff Writer

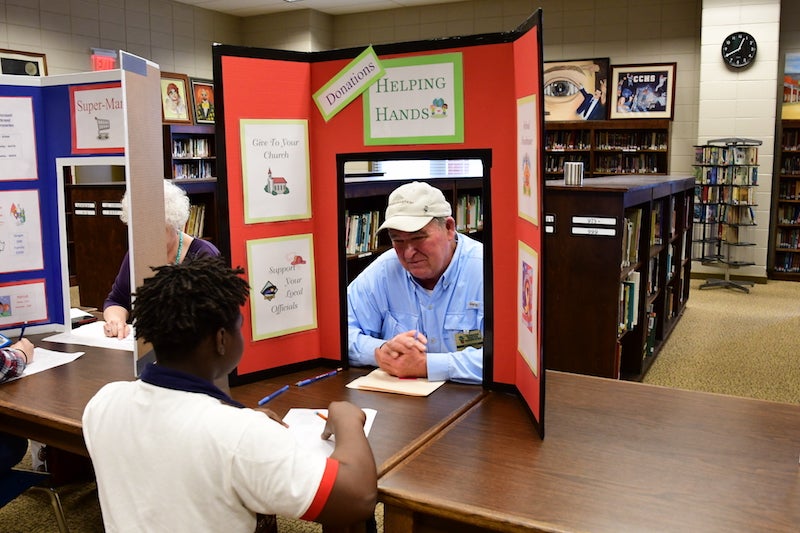

Clanton Middle School eighth-grade students got a taste of adulthood during the Alabama Cooperative Extension System 4-H’s Reality Check simulation on Feb. 16.

Aimee Gilliland, family and consumer science teacher, coordinated the event.

“Our classroom topic right now … is consumerism, and there is a lot that falls under that, learning about pay checks and wages … and how to manage your money, budget to see where you are spending your money,” Gilliland said.

This unit of study follows a focus on careers and future goals. She said students seeing salary numbers may think they are going to be rich, “but it’s a lot harder to manage that money.”

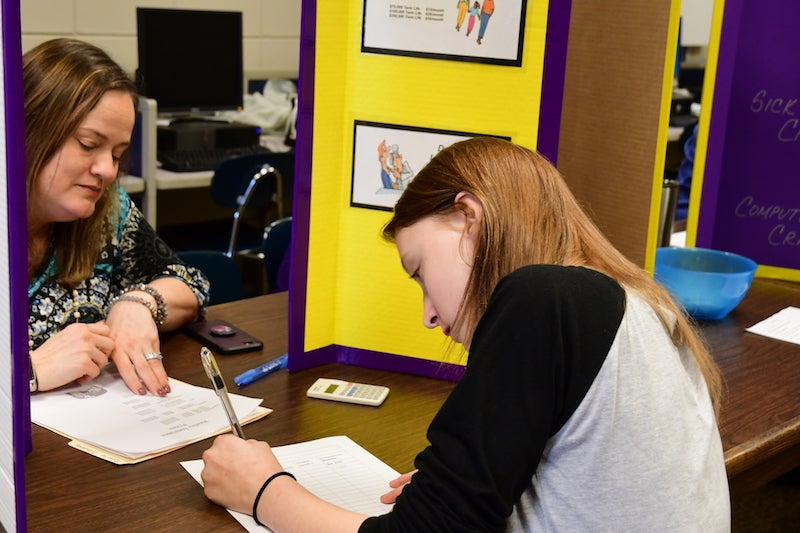

Gilliland said the simulation allows students to see the impact of taxes and bills on how far a pay check goes.

Each student received a career, salary, family scenario and pet.

Student Thomas Cleckler was given a military career, married with a daughter in his scenario.

Students were required to secure housing, transportation, food, utilities and insurance. Some stations included optional items such as fun and making donations.

“It has really helped me learn to budget my money out when I get older, because if I don’t budget my money out, I am will end up having nothing, no money available in savings if something goes wrong,” Cleckler said.

Many of the scenarios with spouses had additional funds to work with.

Those who had children also had to secure childcare.

“Children cost a lot,” Cleckler commented at the end of the simulation.

He said he had not budgeted wisely, and health insurance was more than he expected it to be.

Student Amori McClammy’s scenario was a licensed practical nurse and married with children. She said health insurance “was more than I expected it to be.” She opted to buy a house rather than rent.

McClammy said she enjoyed “getting to know what our parents have to go through when they have to pay” for things.

A challenging aspect for her was buying a car.

“You were tempted to get the most expensive brand new BMW, but you have to think about all the other things that you have to get,” McClammy said.

She had chosen to pay for groceries first.

Student James Logan Smith said Larry Jones at the car dealership had tried to talk him into a BMW, but he chose a Chevy instead.

His scenario was a respiratory therapist and married with no children.

During the simulation, students also saw the consequences of poor financial choices.

Smith said choosing a house was challenging as was balancing out expenses with fun. He had gone straight to the fun station.

“I immediately regretted it, because I spent $1,260 on going out to eat, a movie and a concert,” Smith said.

He said the activity has taught him “don’t go to fun first, get insurance and utilities first.”

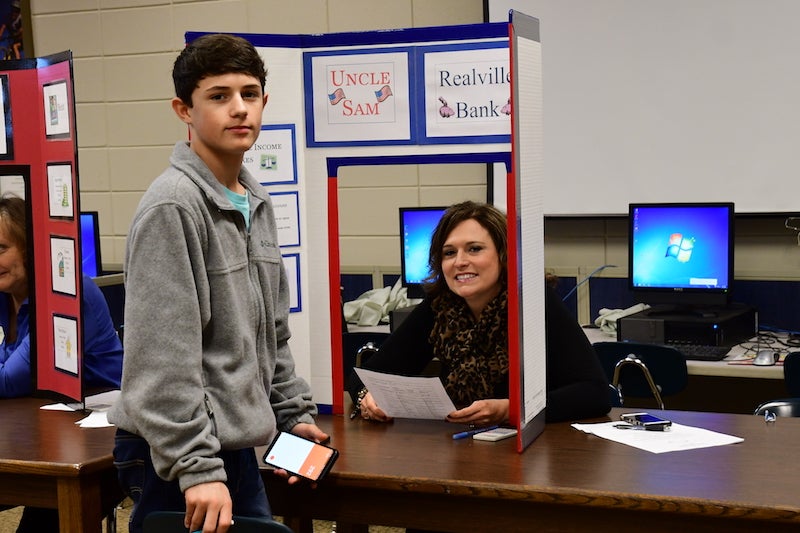

Melinda McCullough of Capital Investment Advisors served as the bank teller for the event.

Her company also served as a sponsor.

“I have an eighth grader who is in one of these classes, and the thing I see from him and his friends is they have no concept of how much everything cost,” McCullough said.

She encouraged students in the simulation, just as she tells her real clients, to put 10 percent of what they make in a savings account before they pay any bills. She said this ensures there are funds available in case of an emergency.

Some students had to return cars or houses to pay off unexpected expenses.

Master Gardeners, 4-H agents and Beth Hicks of Nationwide also served as businesses for the event.